It shows the relation between the portion of assets financed by creditors and the portion of assets financed by stockholders. When a company’s shareholder equity ratio is at 100%, it means that the company has all of its assets funded with equity capital instead of debt. This could happen because the company is generating strong earnings that paid debt over time and constituted more equity for the shareholders. If a company sold all of its assets for cash and paid off all of its liabilities, any remaining cash equals the firm’s equity. A company’s shareholders’ equity is the sum of its common stock value, additional paid-in capital, and retained earnings. The shareholder equity ratio indicates how much of a company’s assets have been generated by issuing equity shares rather than by taking on debt.

This is good when operating income is rising, but it can be a problem when operating income is under pressure. For example, in the quarter ending June 30, 2023, United Parcel Service’s long-term debt was $19.35 billion and its total stockholders’ equity was $20.0 billion. If a company’s debt to equity ratio is 1.5, this means that for every $1 of equity, the company has $1.50 of debt. For someone comparing companies in these two industries, it would be impossible construction accounting guide to tell which company makes better investment sense by simply looking at both of their debt to equity ratios. If you are considering investing in two companies from different industries, the debt to equity ratio does not provide an effective way to compare the two companies and determine which is the better investment. In most cases, a low debt to equity ratio signifies a company with a significantly low risk of bankruptcy, which is a good sign to investors.

First, however, it’s essential to understand the scope of the industry to fully grasp how the debt-to-equity ratio plays a role in assessing the company’s risk. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth.

For example, Nubank was backed by Berkshire Hathaway with a $650 million loan. The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. Understanding the Liabilities to Equity Ratio can offer invaluable insights into a company’s financial health and stability. As with any financial metric, it’s essential to consider it as part of a broader analysis rather than in isolation. In fact, debt can enable the company to grow and generate additional income.

Over time, the cost of debt financing is usually lower than the cost of equity financing. This is because when a company takes out a loan, it only has to pay back the principal plus interest. If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each. A high D/E ratio suggests that the company is sourcing more of its business operations by borrowing money, which may subject the company to potential risks if debt levels are too high. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans.

Debt-to-equity is a gearing ratio comparing a company’s liabilities to its shareholder equity. Typical debt-to-equity ratios vary by industry, but companies often will borrow amounts that exceed their total equity in order to fuel growth, which can help maximize profits. A company with a D/E ratio that exceeds its industry average might be unappealing to lenders or investors turned off by the risk.

By learning to calculate and interpret this ratio, and by considering the industry context and the company’s financial approach, you equip yourself to make smarter financial decisions. Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle. The D/E ratio is a powerful indicator of a company’s financial stability and risk profile. It reflects the relative proportions of debt and equity a company uses to finance its assets and operations.

This method is stricter and more conservative since it only measures cash and cash equivalents and other liquid assets. If the company is aggressively expanding its operations and taking on more debt to finance its growth, the D/E ratio will be high. If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures.

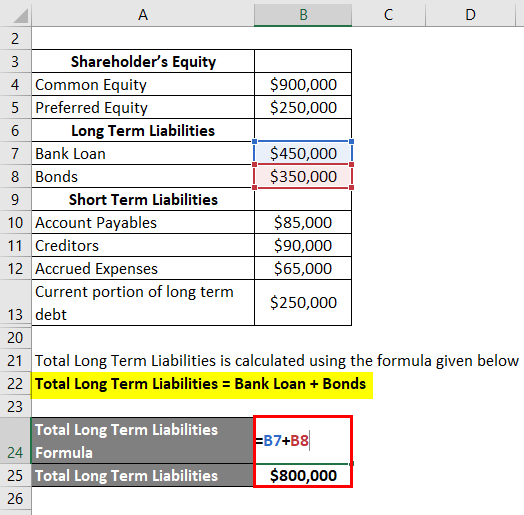

Debt to equity ratio is calculated by dividing total liabilities by stockholder’s equity. The company has then the option to keep a high shareholder-equity ratio or take on debt to lower it and invest in projects to grow using this debt capital. Where long-term debt is used to calculate debt-equity ratio it is important to include the current portion of the long-term debt appearing in current liabilities (see example). A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage. From the above, we can calculate our company’s current assets as $195m and total assets as $295m in the first year of the forecast – and on the other side, $120m in total debt in the same period. While acceptable D/E ratios vary by industry, investors can still use this ratio to identify companies in which they want to invest.

The shareholder equity ratio is expressed as a percentage and calculated by dividing total shareholders’ equity by the total assets of the company. The result represents the amount of the assets on which shareholders have a residual claim. The figures used to calculate the ratio are recorded on the company balance sheet. While taking on debt can lead to higher returns in the short term, it also increases the company’s financial risk.

Debt-to-equity ratio of 0.25 calculated using formula 2 in the above example means that the company utilizes long-term debts equal to 25% of equity as a source of long-term finance. The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another. Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy. Suppose a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet. The formula for calculating the debt-to-equity ratio (D/E) is equal to the total debt divided by total shareholders equity.